Free Money!

if you already understand how money is created by banks making loans, you can get straight to the trick of how governments can create free money without causing inflation, otherwise, you're going to need to read the preamble first.

Preamble

It's a well known fact that governments if they wish, can just print more money. It's also a well documented fact that if they print too much of it, it simply leads to inflation, so while it really is the case that metaphorically speaking Government does have a "Magic Money Tree", it's also the case that magic has its costs.

The thing is, private banks have been creating money out of thin air for hundreds of years. Banks don't loan you existing money. They "magic" new money into existence when you take out a loan using an accounting trick, and "magic" that money out of existence when you pay it back. Yes, it creates inflation; We live with a pretty constant low level of inflation, and massive inflation in house prices, which is where most of the money goes.

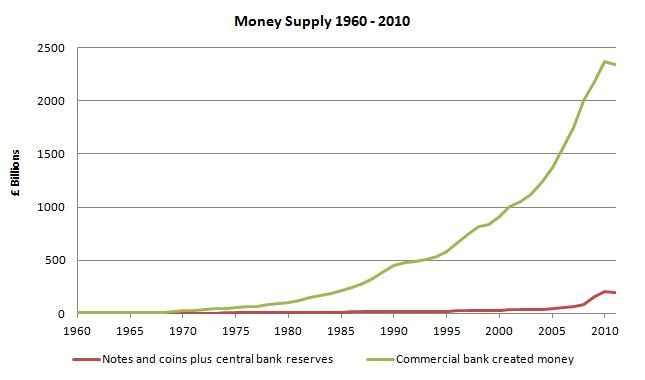

Since the 1960's and 70's though, it got really out of hand. The image below shows how much money private banks have created since that time. Banks have multiplied the amount of money in circulation by some two hundred and fifty times. That's right, there is two hundred and fifty times more money in circulation now than there was in 1960. Not double, not triple, there is two hundred and fifty times more money in circulation in 2019 than there was in 1960.

The above image supplied by Positive Money who provide brilliant educational materials about money supply and you should look them up if you want more details or clarification on this subject.

The above image supplied by Positive Money who provide brilliant educational materials about money supply and you should look them up if you want more details or clarification on this subject.

Once we understand that we can just print money out of thin air, and that private (high street) banks just do this every time they create loans, you might start to appreciate that if we restrict the amount of money banks are creating it will reduce the money supply. Reducing the money supply can be really bad, and reduced bank lending is what led to the 2008 banking crash. However, had government simply stepped in and created the money the banks weren't creating at the time, the money supply would have remained stable, and the crash would not have happened.

So Here's the Trick.

If we limit the amount of money banks can create... the money supply drops, but if government steps in at the same time and creates new money, it can spend it on whatever it likes, without causing new inflation. So the question becomes how do we limit the amount of money that banks create, and it turns out there are at least a few possibilities.

1. Simply make it more expensive to borrow money, so that people borrow less of it. This can be done by increasing interest rates, or taxing loans.

2. Legislate the amount banks are allowed to lend. If we were to legislate such that banks were not allowed to lend a person more than their current salary, you might think that no one would be able to buy a house... but eventually what would happen is that house prices would have to fall to an amount people could afford. It's only because people have been willing to borrow more and more, that we've ended up with this ridiculous house price inflation in the first place. If people couldn't borrow so much, house prices couldn't be as high.

if government want to create money, while keeping the overall money supply constant, and preventing inflation they simply have to limit the amount of money that banks can create. They can then create as much money as they've stopped the banks from creating, without increasing the overall money supply.

The Current Situation

(Note: the need to be able to get the text in the graph means they're graphically disproportionate. The 2% should of course be a slither on the end of the graph, and nothing like as large as it's presented here)

| Total Money Supply (£2.5 Trillion) | |

|---|---|

| Private Bank Created Money (98%) | Govt Created Money (2%) |

A Couple of Possible Future Situations

| Total Money Supply (£2.5 Trillion) | |

|---|---|

| Private Bank Created Money (50%) | Govt Created Money (50%) |

| Total Money Supply (£2.5 Trillion) | |

|---|---|

| Private Bank Created Money (2%) | Govt Created Money (98%) |

Now I'm not suggesting we need to leap in at the deep end and prevent private banks from creating money, although we certainly should be questioning how banks abuse usury. I'm merely suggesting there is space, by using the same accounting tricks that banks use, to balance money creation such that it is not done purely for the benefit of private banks and global capitalism, and shift it such that it benefits society as a whole. There's a couple of trillion pounds available, depending on how we manage the situation.

There is an argument to suggest that the 50/50 balance makes sense, to prevent abuse by government and create a state balanced between private and government control.

But it seems evident to me that government should have more control of creating currency than it currently does. A government in control of its own currency always has the power to create employment, and direct its population onto whatever projects it wishes. There is no need to ever have unemployment if government has control of it's own currency, and can create the money required to employ people doing useful and constructive work which benefits society as a whole, and not just shareholders.

The question is that while private banks are creating our currency, is it our government who are in control, or the banks? Answer; It's currently the banks.

A final note: While banks destroy money by getting people to pay back their loans, government can destroy money by taxing people to take it off them, and then simply wipe it out of existence. There is no reason why the amount of money in circulation needs to increase to do any of what I have suggested above.