How Money Is Created in the Modern Economy, and why this Proves Austerity was a Scam.

"The majority of money in the modern economy is created by commercial banks making loans." Note, that's the Bank of England saying that, not just me.

Only about 2% of our money is notes and coins created by the Royal Mint. The other 98% is created when banks make loans.

An Example always makes things Easier to Understand.

Let's say you borrow £100.

The bank don't go into their vault, and get £100, and put it in "your bit of the vault." All they do is make a note in your account that you now have £100, and they make a corresponding note in another ledger, that you owe them £100. No actual money has moved. In fact, that money doesn't even need to exist in any physical form.

If you pay someone else that £100, the numbers move from your account to their account, and still no actual money (notes or coins) have left the banking system. All that's changed is the numbers on the account books (or on computers these days).

The money in your account, is just numbers on a computer, and when you eventually pay back a loan.... you no longer have it, the bank removes the note from their ledger that you owe it, and all record of that money vanishes... that money literally ceases to exist.

If we paid back, all the debts in the world, there would be no money. OK, that's not quite true, we'd still have the 2% that exists as notes and coins, but if we paid back all the debt, 98% of money would cease to exist.

People borrow hundreds of thousands if not millions to buy houses , and yet people never take more than a few hundred out of their accounts at a time. So banks can "lend" much much more, than they actually have in their vaults. FTR there are laws to prevent people trying to get everyone to take all of the money out at once, because it would destroy the banking system.

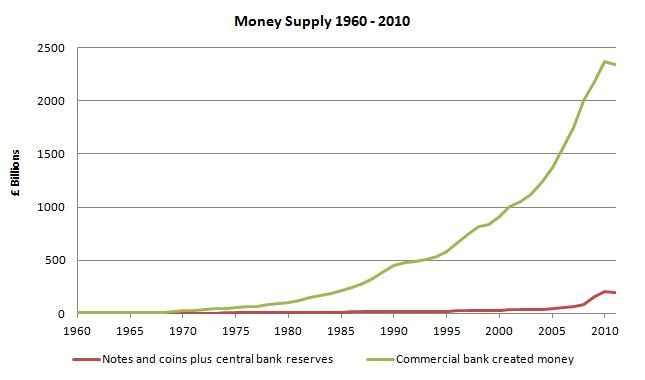

Over the years, banks have, to put it mildly, abused this system. In 1960 there was less than £10 billion in existence. In 2019 there is around £2.5 TRILLION. Over the last 60 years, banks have multiplied the amount of cash in the economy by some 250 times...

... and then blamed inflation on people wanting higher wages. As if multiplying the amount of money in existence by 250 times isn't going to be the cause.

Overall the system works, but there is a fundamental problem with it; Interest payments. If I lend you £100, but I want you to pay me £120 back... where are you going to get the additional £20? It's money someone else has to borrow, so that you can earn it from them... but if they borrowed the money, and they have to pay interest on what they borrowed...

Eventually the entire thing came to a head, with the banking crisis of 2008.

The above image supplied by Positive Money who provide brilliant educational materials about money supply and you should look them up if you want more details or clarification on this subject.

Note the dip on the far right of the Graph. The Green line shows how the amount of money in circulation dropped, because banks stopped lending following 2008, when they realised people couldn't pay it back.

The lower red line shows how the government created a huge amount of new money in the form of Quantititative Easing, to try and keep the overall money supply stable.

Here's the Bit which demonstrates how Austerity was a Scam

As of 2019, The UK government have created £435 billion in quantitative easing. They could have spent that money directly into the economy. They could have used it to pay for nurses and schools. To build hospitals. To pay for all the things they claimed they couldn't afford because of the deficit and the need for "austerity". They chose not to. They chose to cut services, and to simply buy back government bonds with that money instead. That is to say, they handed the money over to very rich people, in the hope that those very very rich people would then lend it to other people and get it back into the economy. What they did was better than not doing anything. What they did stopped the entire system from collapsing... but they could have just spent the money on things we wanted instead; Like public services.

The point being, there was no need for austerity. Because the overall money supply was falling at the time, the government could literally just create new money to fill the gap, without causing any additional inflation. It was about keeping the money supply stable, or at least increasing at the same rate, and not letting it fall.

To Add Insult to Injury

The government (Of Cameron and Osborne) then blamed the need for austerity on the previous government. That was a categorical, out and out lie. The huge deficit following the banking crisis was caused by a decrease in funds coming in, as tax income dropped, and not by overspending by the previous government.

Tories tell lies, who knew?